What costs should I know for Part C?

Before you choose to enroll in a Part C (private Medicare Advantage or MA) health plan, you should check to see what costs you may have. These costs may include:

Premiums

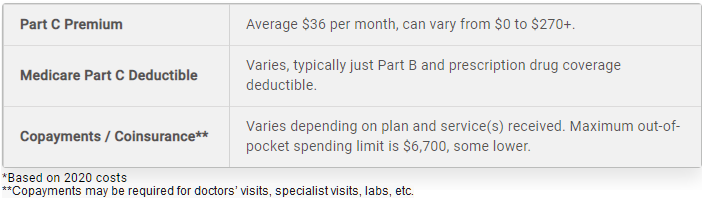

Medicare Advantage plans are sold by private insurance companies, so premium costs can differ according to plan type, provider and location. In 2022, the average monthly premium for a Medicare Advantage plan is $62.66 per month. Remember that you must have Medicare Parts A & B to join a Medicare Advantage plan.

You pay your usual Part B premium plus any additional premium that the plan may charge. Some MA plans may pay a portion of your Part B premium; check with the plan to see if this is the case.

Deductible

Only some Medicare Advantage Plans have an annual deductible, in addition to the standard Part B deductible. Plans that include prescription drug coverage may charge another deductible for drug coverage.

Copayments

Copayments are for specific services, such as doctors’ visits. Usually copays are a flat dollar fee, unlike the coinsurance percentage of traditional Medicare. Some types of plans charge higher copays to see providers out of your network.

Each year, plans establish the amounts they charge for premiums, deductibles and services. Each Part C plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities or suppliers that belong to the plan for non-emergency or non-urgent care).

These rules can change each year, but what you pay may change only once a year, on January 1. For current Medicare beneficiaries, the maximum out-of-pocket spending limit is $7,050 in 2022. If you use out-of-network providers, the limit may be higher. Some plans offer an out-of-pocket limit below the $7,050 maximum.

Medicare Part C Out-of-Pocket Costs*

What are the costs of SNPs?

SNPs are Part C plans that only admit people with Medicare who:

- Have certain serious chronic medical conditions, or

- People who have Medicaid and Medicare, or

- People who live:

- In certain nursing homes or

- At home but have high care needs and could qualify for a nursing home.

If you have both Medicare and Medicaid, most of your costs will be covered by those programs. If you don’t have Medicaid or get help from other programs (such as Medicare Savings Programs, your costs may be similar to what you would pay in a regular Medicare Advantage plan.