What costs should I know for Part D?

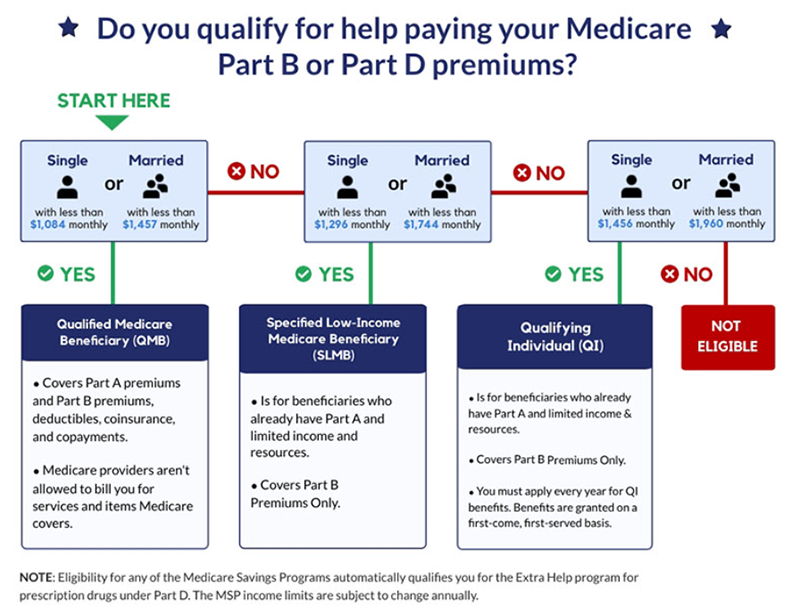

Medicare will pay part of the costs of prescription drug coverage for everyone who enrolls in a plan. How much you pay will depend on which prescription drug plan you choose and whether or not you qualify for Extra Help which helps cover the costs of this coverage.

These are either PDP (stand alone) or MAPD (with prescription plans. Each year the government provides XXXX amount to manage your drug coverage needs. Call us at 480.369.6965 so we can explain exactly how the PDP plans work and provide assurance that you are choosing the ideal plan for you to manage your particular formulary.

Why it's so important to "assure" yourself with Marsh Assurance when selecting your PDP or MAPD

The monthly premiums and deductibles will vary based on plan you choose and where you live.

Again, it is important to understand that we can't determine what is the best option for you by just selecting the cheapest premium plan. The cheapest premium is not always the best plan choice for you depending on formularies being taken. By reviewing personal situation and changes Marsh Assurance group will always present you with the top 3 options that best tailors your formulary needs.

Please have your drug prescription, quantity, and dosage readily available for the Marsh assurance educator at time of discussion to guarantee self surety that you have the best PDP plan specific to your needs.

You will need to revisit this plan to determine what changes to the plan and to your personal health changes during Annual Election Period (AEP) to assure yourself that you on the best formulary plan to meet your prescription needs for the next year (these are yearly contracted plans and need to be reviewed annually).

Our primary goal to you will always be to minimize cost without jeopardizing quality or need!

- How will we do that with the PDP (stand alone)? We will find plan that will provide you with the formularies that you need at the cheapest cost! Making sure that we keep your pharmacy, drug quality, and any other requirements in complete focus.

- How do we determine best option for the MAPD? We mentioned that the advantage plans may carry prescription coverage. We really need to monitor these plans yearly because all the formularies on each plan differ. Where one carrier may have a drug listed as a tier 3 another may have it as a tier 2. It is our goal to look at this yearly and discuss changes and best solution. These are focused on plans benefit not personal individual's so this does take some research which we are always happy to provide to determine option available.

Part D Monthly Premium

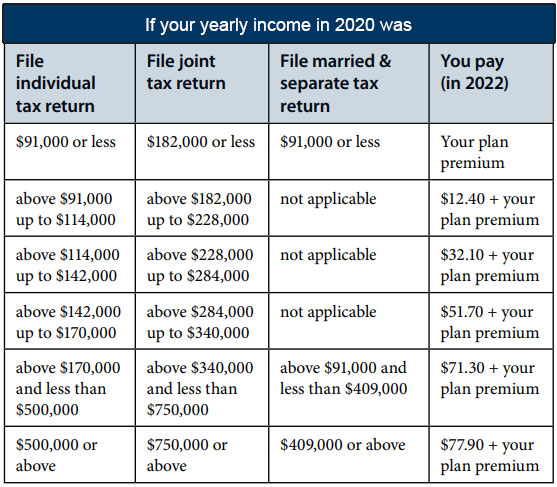

The chart below shows your estimated drug plan monthly premium based on your income. If your income is above a certain limit, you’ll pay an income-related monthly adjustment amount in addition to your plan premium.

Medicare Part D Deductible

Remember a plan with a deductible will not pay for your prescriptions until you pay the deductible amount out-of-pocket. Medicare beneficiaries will see a Part D deductible up to $480 in 2022, followed by an Initial Coverage Period in which they will be responsible for 25% of costs up until they reach the threshold of $4,130 spent on prescription medications.

Some plans offer $0 deductible and will pay for your prescriptions right away. Other plans may offer a deductible lower than the maximum of $480 such as $150 or $250. You will generally only want to choose a plan with a $0 deductible if it also has the lowest overall cost per year, including the costs for the drugs you take.

Copayments and coinsurance

A copayment, or copay, is a fixed dollar amount for your prescriptions. For example, you might have to pay $5 for a generic drug, $25 for a "preferred" brand name drug and $40 for a non-preferred brand name drug.

A coinsurance is a percentage of the price of your prescription. Typically plans require coinsurance for drugs listed in higher tiers like tier 4 and tier 5 drugs. For example, if your prescription costs $350, and your coinsurance is 25%, you will pay $87.50.

It is possible that some of your medications require a fixed copayment and others a coinsurance. Be sure to check the cost of each medication you take with the plan.

You will generally only want to select a plan with low copays or coinsurance if it also has the lowest overall annual cost per year, including the costs for the drugs you take.

What are copay tiers?

Each plan places the drugs it will pay for in different levels, called tiers. Each tier has its own copay or coinsurance amount. Your drugs may be included in all the plans in your area, but they could be listed on different tiers with different copay amounts.

Each plan will encourage you to use the lowest-cost drug to treat your medical condition. A drug on a lower tier will cost less than a drug on a higher tier.

Phases of Part D Prescription Costs

Prescription drug costs may change throughout the year depending on which phase of Part D coverage you are in. There are four phases of Part D coverage:

Deductible Period: During this time, you will pay the full negotiated price of your drugs until you meet your Part D deductible. After you have met your deductible, your plan will begin to cover the cost of your drugs. The maximum Part D deductible is $480.

Initial Coverage Period: This period occurs after you have met your deductible and your plan begins to cover your drug costs. During this period, your plan will cover some of the drug cost and you will pay your copayment or coinsurance. Each plan will define the amount of time that you will remain in the initial coverage period. On average, most plans define this as the point when you have accumulated $4,130 in total drug costs (this is the total amount you and your plan have spent during this period).

Coverage Gap or Donut Hole: The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people with Medicare won't pay anything once they pass the Initial Coverage Period spending threshold. As the chart below shows, total out-of-pocket costs will need to reach $7,050 before a beneficiary reaches the Catastrophic Benefit Period.

Catastrophic Coverage: This period begins after you have paid $7,050 in out-of-pocket costs. This amount is based on how much you spend on prescription drugs, not how much your plan also pays towards your prescription drugs or total drug costs (see more detailed information below in "What counts as my "true" out-of-pocket costs?")

Catastrophic Coverage

In Part D, you and the plan you join share the cost of drugs. The money that you spend is called your out-of-pocket costs. That determines if and when the catastrophic coverage begins. The catastrophic coverage starts when you have paid $7,050 out-of-pocket.

- Once you have spent $7,050 for drugs during the year, you would then pay 5% or less of the cost of your drugs for the rest of the calendar year.

- There is no cap or limit on the amount of drugs you can obtain after you have spent $7,050 out-of-pocket.

Your drug plan will keep track of your out-of-pocket drug costs. They will send you a report each month you buy drugs.

Medicare divides drug costs into two different groups:

- Your "true" out-of-pocket costs: These are drug costs that count toward the start of your catastrophic coverage. This includes the 50% discount amount the drug manufacturer pays for brand name drugs while you are in the coverage gap.

- All other drugs you bought that do not count toward your catastrophic coverage.

Others can help you pay all or part of your costs:

- Another person

- A registered charity

- A State Pharmacy Assistance Program

- Drug manufacturer Patient Assistance Program – check with each company’s program to find out if costs will count towards your “true” out-of-pocket costs

- Drugs that Indian Health Services or AIDS Assistance Programs provide

What costs do not count toward my share of the costs?

- The premium for your drug plans (Medicare Part D plan or Medicare Advantage Prescription Drug plan)

- Drugs you bought that are not on your plan’s drug list (formulary). Note that if you and your doctor get your plan to approve a drug not on the plan’s drug list, then the costs for that drug do count toward your share of the costs and catastrophic coverage.

- The discounts during the coverage gap that are paid by the plan, meaning the 21% discount on generics and the 2.5% discount on brand name drugs

- Costs that third parties — such as employers and union insurance plans – paid for you

- Drugs you bought that Medicare does not cover

- Drugs you bought from a pharmacy that was not in your plan’s network

- Over-the-counter drugs

Whether you decide to carry Original Medicare, Medicare Advantage (MAPD), or a Medicare Supplement with a stand- alone PDP it is necessary to revisit each year to determine what plan is best tailored for your own personal healthcare needs. Here at the Marsh Assurance group we will be sure to help you revisit these prescription needs during each annual election period (AEP) to assure yourself that you are on the best healthcare solution year to year. As we mentioned, the plans formularies may change or your personal prescription needs may change.

Example: If one plan recognizes a particular drug name as a tier 3 that doesn't mean that all the plans recognize that prescription to be a tier 3. We may be able to be find it on a lesser tier class with a different carrier. Do not feel like the PDP you first choose is the one you need to maintain forever. All PDP's consists of both positive and negatives depending on personal situation.

Assure yourself by allowing the Marsh Assurance group the opportunity to compare based on cost, formulary, and specific needs of the plan click here. This may be a huge savings and potentially keep you out of the coverage gap or at least postpone it from happening.