What costs should I know for Part A?

Premiums

Most people do not have to pay a premium for Part A because they (or their spouse) paid for it while they worked. If you do have to pay Part A premiums, the longer you or your spouse worked and paid into Social Security, the lower your premiums will be.

If you don’t get premium-free Part A, you pay up to $499 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Deductible

Part A doesn’t have an annual deductible but rather applies a deductible to each hospital benefit period. A benefit period begins when you go into a hospital or skilled nursing facility (SNF) and ends when you have been out of the hospital or SNF for 60 consecutive days.

Hospital Stay

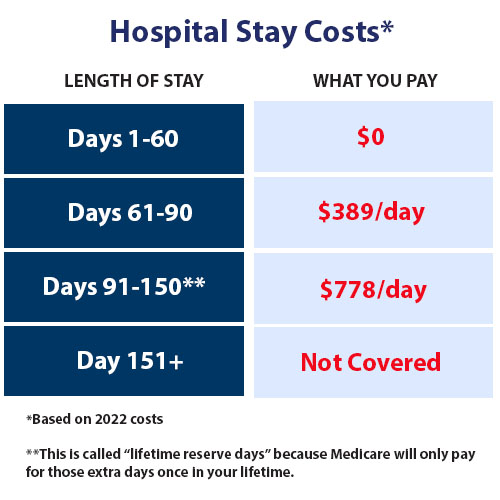

Copayments

Copays for Part A apply once you stay in a hospital for more than 60 days in a single benefit period. In a skilled nursing facility, copays begin after the first 20 days.

If you have a limited income and resources, you may qualify for help with your Parts A & B costs.

Part A covers the following:

- Inpatient Hospitalization

- Skilled Nursing

- Blood

- Healthcare

- Hospice

Skilled Nursing Facility Stays

For a skilled nursing facility stay, there is no deductible. Medicare will only cover up to 100 days in a skilled nursing facility though, and only if you meet some very specific criteria:

- 3-Day Hospital Stay: You must have been at a hospital

- For 3 days AND

- Had come to a skilled nursing facility within 30 days of the hospitalization AND

- Had been admitted to the hospital as an inpatient. Time in the emergency room or in what the hospital calls “observation status” does not count, even if you stayed overnight or longer.

- Level of Care: You must also need skilled nursing care 7 days a week, or skilled therapy services 5 days a week.

- Part A: Skilled nursing care is covered under Medicare Part A. You must have had Part A while you were in the hospital.

Also, keep in mind that Medicare will NOT cover your stay if you only need help with personal care (also called custodial care), such as bathing, eating or dressing yourself.

In 2022, you pay:

- $0 for the first 20 days of each benefit period

- $194.50 per day for days 21–100 of each benefit period

- All costs for each day after day 100 of the benefit period

Home healthcare services

There is no deductible or copayment for home healthcare. However, you do need to meet a set of very specific criteria in order for Medicare to cover your home healthcare.

Medicare covers home healthcare services when a doctor certifies that:

- You need medical care at home AND

- You are homebound AND

- You need skilled care from a nurse or a skilled physical, speech or occupational therapist.

Medicare will only cover home care services when your doctor:

- Orders the care from a home health agency that Medicare approves, AND

- Documents a face-to-face visit with you up to 3 months before or 1 month after the start of the service, AND

- Signs a plan for your care.

Hospice care

There is no deductible or copayment for hospice care. You only pay a small share of the costs of medications and inpatient respite care under the Medicare hospice benefit.

What costs should I know for Part B?

Premiums

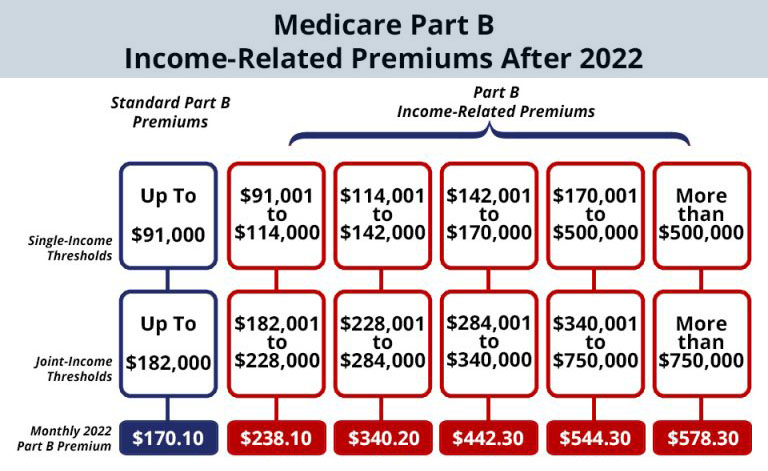

Most people pay the standard Part B monthly premium amount ($170.10 in 2022). Social Security will tell you the exact amount you’ll pay for Part B in 2022. You pay the standard premium amount if:

- You enroll in Part B for the first time in 2022.

- You don’t get Social Security benefits.

- You’re directly billed for your Part B premiums.

- You have Medicare and Medicaid, and Medicaid pays your premiums. (Your state will pay the standard premium amount of $170.10 in 2022.)

Here's what you'll pay: If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard Part B premium and an income-related monthly adjustment amount.

Deductible

You will also pay an annual deductible of $233 per year. That means when you receive services covered by Part B, you will pay $233 before Medicare starts helping you pay. People with Medicare with incomes less than 100% of federal poverty level – about $1,005/month – and few resources can be excused from paying the Medicare deductible and coinsurance.

Coinsurance

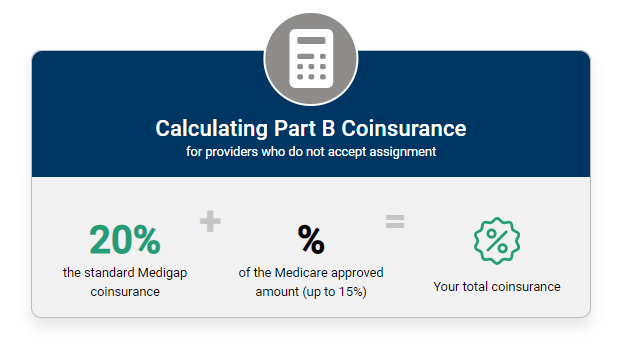

Once you have paid your deductible, you will then pay 20% of the cost approved by Medicare for most Medicare Part B services.

Accepting assignment

To keep your Part B costs down, make sure that your healthcare providers take Medicare and “accept assignment.” Doctors or other providers who accept assignment agree to accept the amount that Medicare will pay for a visit or service (called the Medicare-approved amount) as payment in full. So you would only pay the 20% coinsurance.

Providers who see people with Medicare but do not accept assignment can charge you more. They can charge you up to 15% more than the Medicare-approved amount, which means that you would pay your usual 20% coinsurance plus up to an extra 15%.

For example, if the Medicare-approved amount for a doctor visit was $100, but your doctor did not accept assignment, he could charge you up to $115 for your visit. You would pay $35 (20% of the $100 Medicare-approved amount, plus the extra $15 not covered by Medicare).

Opting out

Providers can also “opt out” of the Medicare program. That means that they can charge you whatever they like for a service and will not bill Medicare. If you see a provider that has opted out of Medicare, you will have to pay the full cost of the service you receive; Medicare will not pay any part of the cost. Providers that opt out of Medicare should have you sign a contract saying that you understand that you will have to pay the full cost of the service.

No Maximum out of pocket expense with Original Medicare which is why less than 1% of those eligible and enrolled in Medicare are on Original Medicare (ABD). Again, never a cost nor obligation for our education and service. Click here to contact us to determine your personal healthcare needs and explain your options, rights, and entitlements.